OUR PRODUCTS

Titanium dioxide (TiO₂) is an essential basic raw material in the fine chemical industry, renowned for its excellent opacity, whiteness, tint strength, and chemical stability. It boasts a wide range of downstream applications, primarily in coatings, plastics, papermaking, and daily chemical products, serving as an indispensable key component across multiple industrial sectors.

Rutile Pigment Titanium Dioxide JMA-110

Recommended application range:coatings, inks, papermaking, plastics, rubber, chemical fibers, and other industries.

General-grade rutile titanium dioxide JMM-2988

Recommended application range:JMR-2988 can be widely used in industries such as water-based coatings, solvent-based coatings, latex paints, powder coatings, road marking paints, marine paints, inks, plastics, papermaking, leather, and related fields.

Rutile Titanium Dioxide for Plastic and Steel Applications JMR-2399

Recommended application range: widely used in the plastics industry for pipes, profiles, PVC, engineering plastics, and other plastic products.

Rutile Titanium Dioxide for Papermaking JMR-2688

Recommended application range:widely used in the decorative laminated paper industry.

COMPANY PROFILE

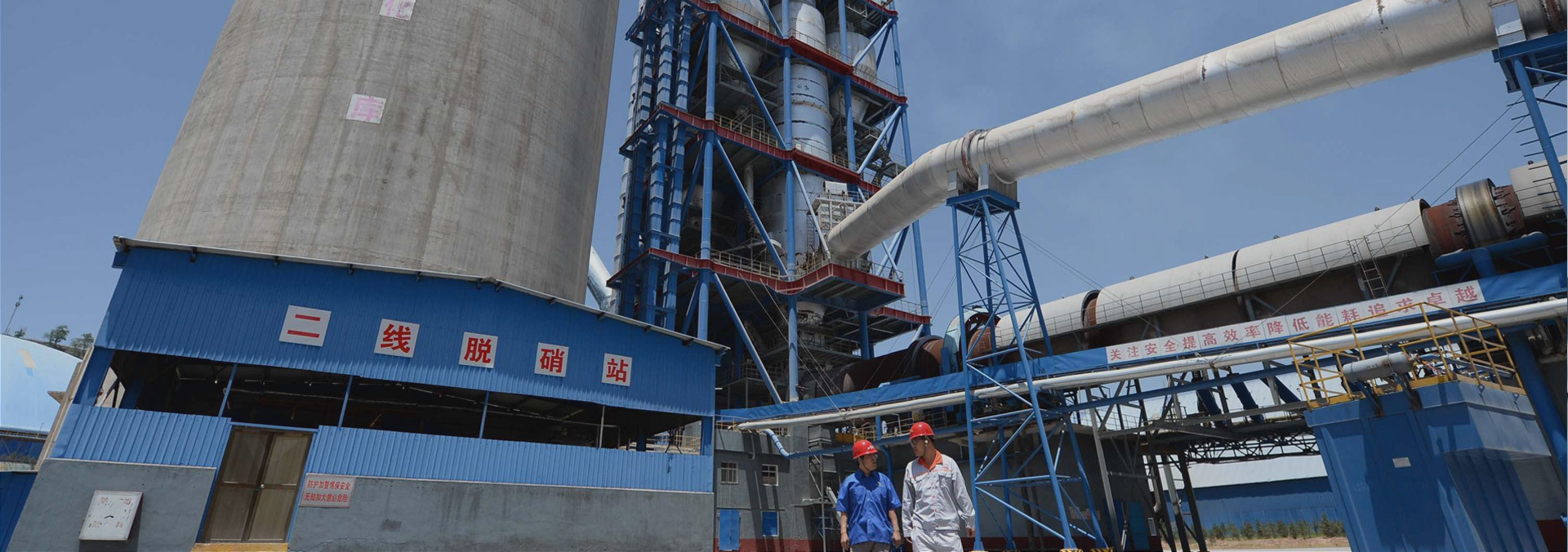

Guangxi Jinmao Titanium Co., Ltd.

INTEGRITY | QUALITY | DEVELOPMENT

Guangxi Jinmao Titanium Co., Ltd. is a large-scale manufacturer mainly producing titanium dioxide. The company locates in Teng County, Guangxi, known as the "Hometown of Titanium Dioxide". It has the advantages of a "four-in-one" three-dimensional transportation network of railways, highways, aviation, and waterways, providing the convinence for traffic. Local products have unique strengths in resources, transportation, cost and market competition. The company's products are widely used in coatings, inks, rubber, plastics, chemical fiber, paper, ceramics and denitrification and other fields. The products are sold to Asia, Europe, Africa, America and other regions, and are well received by customers.

PRODUCT APPLICATION

BLOG & EVENTS

High Quality Win Quartet Customers-Pioneering and Innovative Tree Titanium White Brand

Sincerely welcome the national industry colleagues and friends to visit the guidance

12

/

02

News dynamics

12

/

03

News dynamics

Meeting in Turkey | Jinmao Titanium Meets You at Plast Eurasia 2025

02

/

02

News dynamics

BASED DOMESTICALLY, FACING GLOBALLY

Domestic market:

Beijing, Tianjin, Hebei, Heilongjiang, Jilin, Liaoning, Shandong, Henan, Shaanxi, Shanxi, Jiangsu, Zhejiang, Shanghai, Anhui, Hubei, Chongqing, Yunnan, Sichuan, Hunan, Jiangxi, Guangxi, Guangdong, Fujian, Hainan, Xinjiang, Hong Kong, Macau, Taiwan, etc.

Foreign markets:

India, Vietnam, Thailand, Indonesia, Japan, South Korea, Spain, Germany, Belgium, Italy, Austria, Denmark, Turkey, Egypt, South Africa, USA, Brazil, Mexico, Argentina, etc

Cannot find the product you are looking for? Please contact us!

Jinmao Titanium welcomes you to visit our company!